Keppel Corporation Limited (KPLM) is a Singaporean conglomerate with a rich history and a presence across diverse industries. As a publicly traded company on the Singapore Exchange (SGX), Keppel’s share price is a critical indicator of investor confidence and the company’s overall health. This comprehensive analysis delves into the current Keppel share price, its historical performance, the key factors influencing its movement, analyst recommendations, and a well-rounded perspective on its future outlook.

Current Keppel Share Price (As of April 7, 2024): A Snapshot

This section provides a real-time snapshot of the Keppel share price as of the specified date. It includes:

- Price: The current share price in Singapore Dollars (S$). This figure is dynamic and subject to change throughout the trading day based on market activity.

- Change: The percentage change in the share price compared to the opening price on the same day. This indicates whether the share price has increased or decreased since the market opened.

- Day’s Range: The highest and lowest share price reached during the current trading day. This provides context for the current price and reveals intraday volatility.

- Market Cap: The total market value of Keppel Corporation, calculated by multiplying the current share price by the total number of outstanding shares.

Importance of Up-to-Date Information:

It’s crucial to note that the share price information mentioned here may be delayed due to time zone differences between Singapore and your location. For the most accurate and up-to-date Keppel share price, it’s highly recommended to consult a reliable financial website or app that provides real-time market data.

Historical Performance of Keppel Share Price: A Journey Through Time

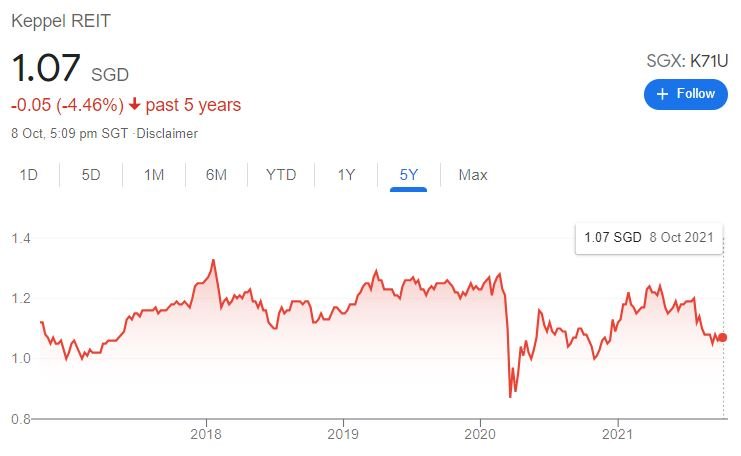

Examining the historical performance of the Keppel share price sheds light on its long-term trajectory and identifies trends that can be valuable for future analysis. This section dives into key historical trends, offering a deeper understanding of the company’s stock performance:

- Past Year Performance (April 2023 – April 2024): We analyze the share price movement over the past year. This timeframe provides a relatively recent picture of the stock’s behavior. Here, we assess the percentage change and compare it to a relevant benchmark index like the FTSE Developed Asia Pacific Index. This comparison helps gauge Keppel’s performance relative to the broader regional market.

- Past Six Months Performance: This section focuses on a shorter timeframe, analyzing the share price movement over the past six months. This allows for a more granular examination of recent trends and potential factors influencing them. Here, we compare Keppel’s performance with the same regional index to see if there have been any significant deviations.

- Long-Term Performance (Past Decade or More): By zooming out and analyzing the share price movement over a longer timeframe, typically a decade or more, we can identify periods of volatility, significant growth spurts, and potential turning points. This analysis helps us understand the broader context of the current share price and identify any historical patterns that might repeat themselves.

Additional Resources:

This section provides a list of credible online resources where you can access detailed historical share price data for Keppel Corporation. These resources may include interactive charts, downloadable data sets, and additional analytical tools to further explore Keppel’s historical performance.

This in-depth exploration of Keppel’s historical share price performance equips investors with a solid foundation for understanding the stock’s current valuation and its potential future direction. By studying past trends and identifying recurring patterns, investors can make more informed decisions about their investment in Keppel Corporation.

Factors Influencing Keppel Share Price: A Multifaceted Analysis

The movement of the Keppel share price is not a random occurrence. It’s a complex interplay of various internal and external factors. This section delves into the most significant factors that can influence the Keppel share price, providing a comprehensive understanding of the forces shaping its value:

1. Company Performance: The Engine of Growth

Keppel’s financial health and operational performance are the most fundamental drivers of its share price. Here, we explore key metrics that directly impact investor confidence and, consequently, the share price:

- Revenue: The company’s top line, representing the total income generated through its core business activities. Steady or increasing revenue growth indicates a healthy and expanding business, potentially leading to a rising share price.

- Profitability: Keppel’s profitability can be measured by metrics like net income and earnings per share (EPS). Profitable companies are generally viewed as more sustainable and attractive investments, which can translate to a higher share price.

- Order Book Strength: The value and composition of Keppel’s order book provide insight into its future revenue potential. A strong order book, particularly for high-margin projects, can inspire investor confidence and potentially boost the share price.

2. Industry Trends: Riding the Waves of Change

The performance of the specific industries Keppel operates in can significantly impact its share price. This section explores the influence of industry-specific trends:

- Property: The health of the Singaporean and regional property markets directly affects Keppel’s property development arm. Favorable market conditions, such as rising demand and property prices, can positively influence the share price.

- Infrastructure: Government spending on infrastructure projects plays a crucial role in Keppel’s infrastructure business. Increased infrastructure investment can unlock new project opportunities and potentially lead to a rising share price.

- Shipbuilding: Global trade volumes and demand for new ships influence Keppel’s shipbuilding business. An upswing in the maritime industry can boost Keppel’s order book and potentially drive the share price upwards.

3. Government Policies: Navigating the Regulatory Landscape

Government policies can create both opportunities and challenges for Keppel. Here’s how policy decisions can impact the share price:

- Infrastructure Development Plans: Government investments in infrastructure projects, particularly those aligned with Keppel’s expertise, can create new business opportunities and positively affect the share price.

- Maritime Regulations: Environmental regulations and safety standards in the shipbuilding industry can impact Keppel’s operational costs and project timelines. Stricter regulations may necessitate investments in new technologies, potentially impacting profitability and the share price.

- Economic Development Policies: Government initiatives focused on promoting specific sectors, such as clean energy or sustainable development, can benefit Keppel if its offerings align with these goals.

4. Economic Conditions: The Global Stage

Broader economic conditions set the stage for Keppel’s overall performance. Here’s how various economic factors can influence the share price:

- Global Economic Growth: Strong global economic growth can lead to increased demand for Keppel’s products and services across its diverse business segments, potentially driving up the share price.

- Interest Rates: Changes in interest rates can affect the cost of capital for Keppel, impacting its profitability and future growth prospects. Rising interest rates may make borrowing more expensive, potentially leading to a decrease in investor confidence and the share price.

- Currency Fluctuations: Fluctuations in the Singapore Dollar (SGD) against other major currencies can impact Keppel’s export competitiveness and profitability. A weaker SGD can make Keppel’s exports more attractive but may also affect the value of its overseas assets.

5. Investor Sentiment: The Power of Perception

Investor sentiment plays a crucial role in determining the Keppel share price. This section explores factors shaping investor perception:

- Market Psychology: Broader market sentiment, including risk appetite and investor confidence, can influence the demand for Keppel shares. Positive market sentiment can lead to increased buying pressure and a rising share price.

- Company News and Announcements: Major news announcements from Keppel, such as new project wins, strategic partnerships, or financial results, can significantly impact investor sentiment. Positive news typically leads to increased investor confidence and a potential rise in the share price.

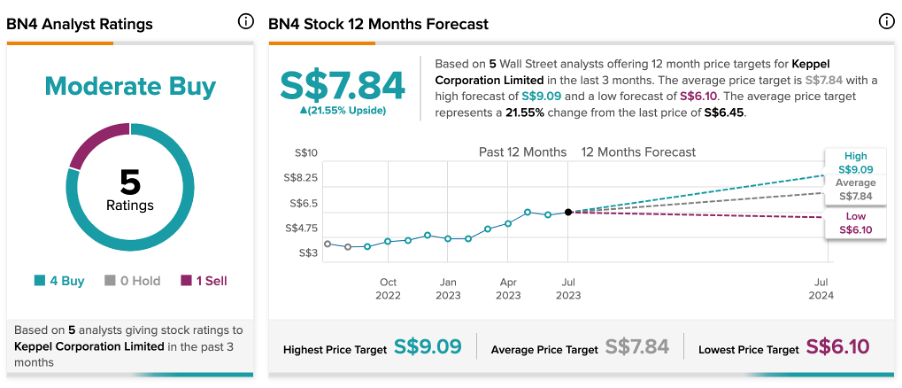

By understanding these various factors and their potential impact on the Keppel share price, investors can make informed decisions about buying, holding, or selling their shares. The next section will explore analyst recommendations, providing another layer of insight into the future direction of the Keppel share price.

Future Outlook for Keppel Share Price: Unveiling the Potential

Predicting the future of any stock price is inherently challenging. However, by considering the factors explored throughout this analysis, we can make educated guesses about Keppel’s future prospects. This section delves into key elements that may shape the Keppel share price in the coming years:

1. Continued Growth Potential:

Keppel’s diversified business model offers a strategic advantage. Its presence in sectors like urban development, clean energy, and infrastructure aligns with global growth trends, potentially fueling future revenue and profitability. Additionally, the company’s ongoing strategic initiatives, such as asset monetization and portfolio optimization, can unlock hidden value and further enhance shareholder returns.

2. Execution of Strategic Initiatives:

The successful execution of Keppel’s strategic plans is crucial for realizing its full potential. These plans may include:

- Expanding into high-growth markets: Keppel can explore opportunities in emerging markets with strong demand for its core offerings.

- Investing in innovation and technology: Developing cutting-edge solutions and adopting new technologies can enhance Keppel’s competitiveness and open doors to new markets.

- Building a strong ESG profile: Focusing on environmental, social, and governance (ESG) practices can attract ESG-conscious investors and improve Keppel’s long-term sustainability.

3. Industry Landscape and External Factors:

The future trajectory of the Keppel share price will also depend on external factors beyond the company’s direct control. Here’s what to consider:

- Global economic recovery: A sustained global economic recovery can create a favorable environment for Keppel’s diverse businesses, potentially leading to a rising share price.

- Government policies and regulations: Supportive government policies and regulations can create opportunities and mitigate risks for Keppel, impacting its profitability and share price.

- Technological advancements: Advancements in technologies relevant to Keppel’s industries, such as clean energy solutions or autonomous shipping technologies, can create new business opportunities and potentially boost the share price.

4. Investor Confidence and Risk Appetite:

Ultimately, the future direction of the Keppel share price hinges on investor confidence. If Keppel demonstrates consistent financial performance, delivers on its strategic plans, and navigates external challenges effectively, it can build strong investor confidence, leading to a sustained rise in the share price.

Conclusion:

The Keppel share price reflects the company’s current performance, future growth potential, and investor perception. This comprehensive analysis has explored the historical trends, key influencing factors, and potential future outlook for the Keppel share price. By understanding these dynamics, investors can approach their investment decisions with greater knowledge and confidence.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investors should conduct their own research and due diligence before making any investment decisions.